Local Market Update – December 2022

As temperatures drop and we approach the end of the year, the local housing market has remained somewhat sluggish — an indication of a return to normal seasonality. Slower home sales are not necessarily a bad sign; in many cases causes as benign as the holidays and inclement weather have pushed buyers off their path, with many choosing to wait for the new year before resuming their searches.

The market is still experiencing high interest rates, though many experts agree we seem to be past peak inflation levels. While the 30-year interest rate recently dropped to 6.49% from the peak of 7.08%, it remains about a point above the June 2022 average of 5.42%. Windermere’s Chief Economist Matthew Gardner expects mortgage rates will continue to drop. “Early in the new year, I expect the Fed to start pulling back from their aggressive policy stance, and this will allow rates to begin slowly stabilizing,” he says. Gardner expects interest rates to remain above the 6% mark until fall of 2023, when they should begin to dip.

Interest rates and weather are not the only things causing buyers to slow their trajectory. The larger amount of inventory in most markets has encouraged buyers to take their time and browse more than they’ve been able to in the past two years. Sellers must now compete with one another for buyers’ attention and offers. That being said, listings that are priced accurately for the market are still attracting showings and strong offers, and there are many sellers who can afford to wait for the right offer.

These trends were reflected across King County in November, which saw a median sold price of $827,000 for single-family homes. That’s up from $820,000 in October, but the more noticeable change was in the number of closed sales. The county saw a 44.7% year-over-year drop in the number of sold units, dropping from 2,371 closed sales in November 2021 to just 1,312 closed sales last month.

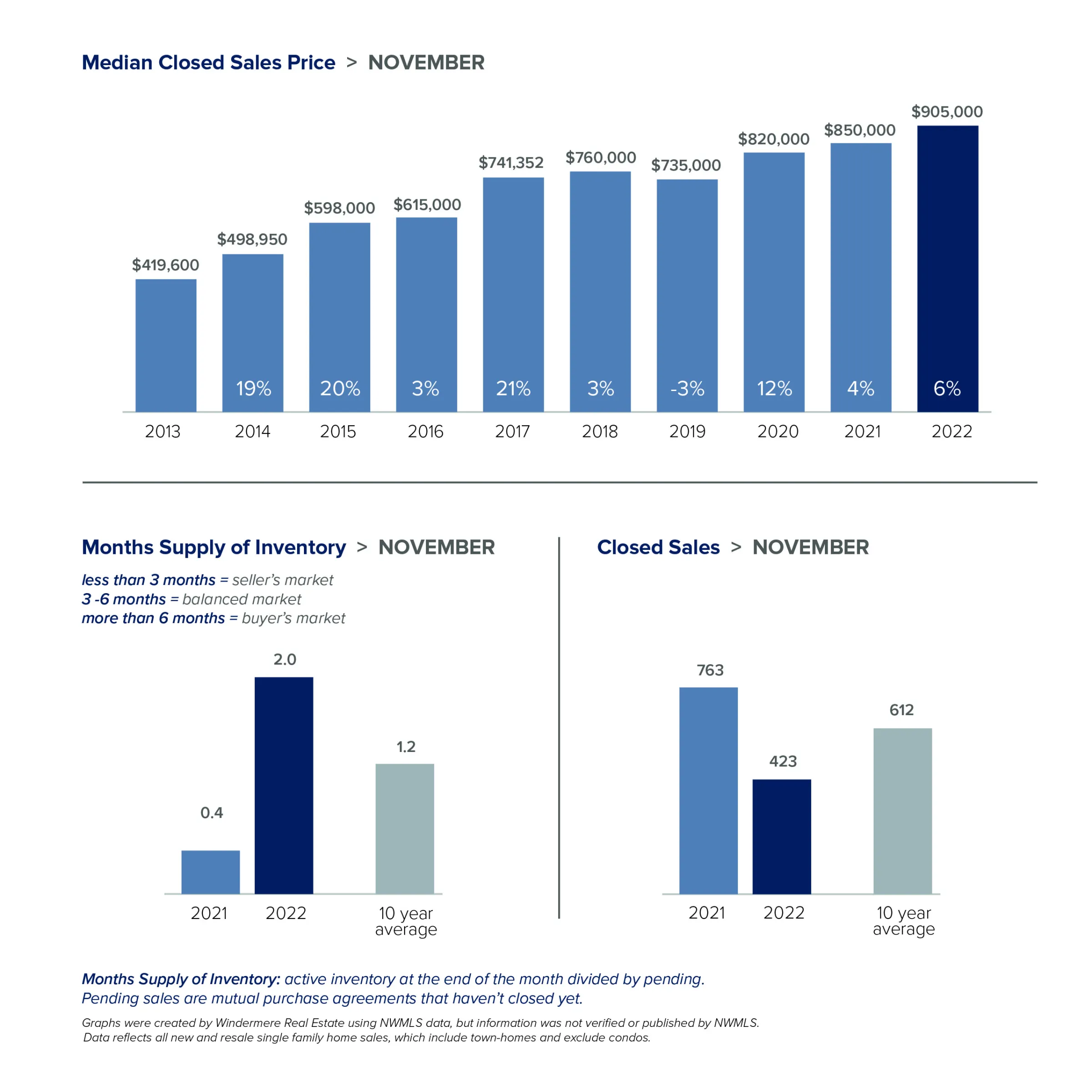

Seattle followed much the same pattern, with a median closed sale price of $905,000 for single-family homes, up from $850,000 the same time last year. Closed sales also decreased from 763 in November 2021 to 423 last month, a drop of 44.6%. Condos in the city experienced an even greater decrease in sales, with a 54% year-over-year dip in sold units.

Prices on the Eastside decreased to a median of $1,316,000 for single-family homes, after holding steady at $1,350,000 since August of this year. The inventory for Eastside single-family homes currently sits at 2.4 months. Condo prices in the area rose from $555,500 in November 2021 to $569,500 last month. Eastside buyers may be opting for condos as a more affordable choice given the current interest rates. Condo inventory in the area currently sits at 2 months.

Last month just 10% of residential units on the Eastside sold above asking price. More than half the listings on the Eastside experienced price reductions in November as well, with 54% of sold listings having had a price adjustment at some point. Despite these recent trends, it’s important to note that median home prices on the Eastside are up 24% over the past two years — from $1,060,000 in 2020 to $1,316,000 last month.

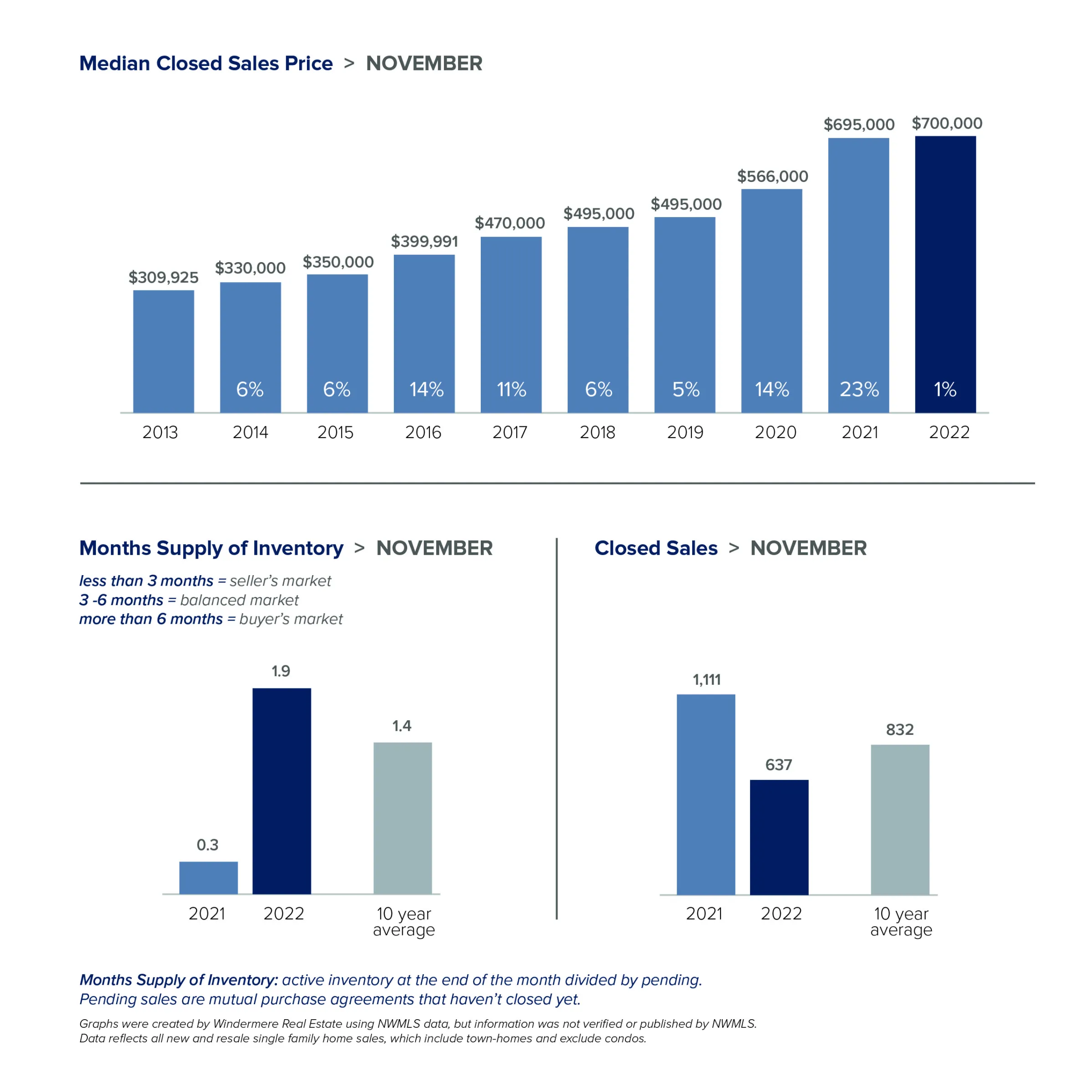

Snohomish County remained somewhat similar to last month, with slightly less than 2 months of inventory on single family homes and a median sold price of $700,000. That’s up slightly year-over-year, from $695,000 in November 2021. Condos in Snohomish County had the least inventory of any area, with only 1.6 months’ supply.

Although interest rates are higher than we’ve grown used to over the past two years, the increased inventory means it is still a great time for buyers, especially first-time homebuyers, to enter the market. Resources provided by the Washington State Housing Finance Commission, including its free homebuyer education seminars and its down payment and closing costs assistance programs, can help counter some of the obstacles that may be keeping buyers sidelined. A savvy combination of interest rate buy-downs, adjustable rate mortgages and the possibility of refinancing for lower rates can also help would-be buyers hit the ground running.

If you have questions about what this market means for you, please feel free reach out to me.

Eastside

King County

Seattle

Snohomish County

This post originally appeared on GetTheWReport.com